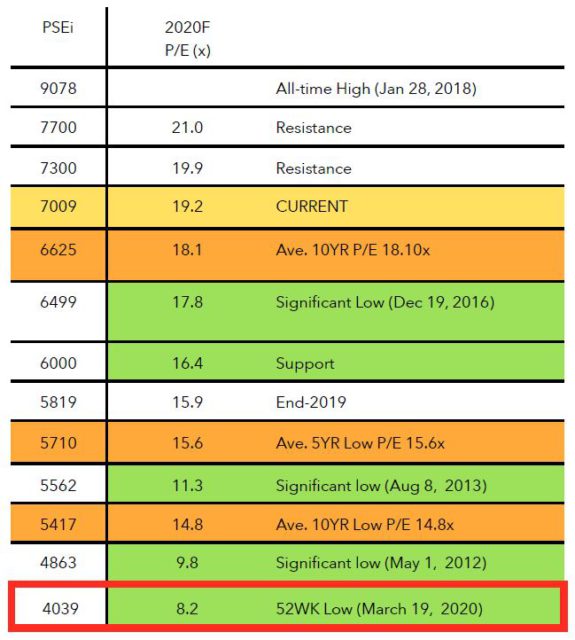

The chart below gives context at each Philippine Stock Exchange Index (PSEi) level in terms of 2020 Forecast Price-to-Earnings ratio:

Key take-aways from this chart:

- At 7,009 current level, we’re actually above the 10-Year P/E Average.

- How I wish I had enough cash to invest in the market at its super-low of 4,039 points in the middle of March 2020.